US Turkey Growers Do Not Receive Same Market Benefit as the Industry

Thanksgiving arrives with an annual focus on food prices. We host friends and family at home with lots of prepared food. One of the annual food price traditions is the American Farm Bureau Federation, Thanksgiving Survey. Regular readers know that this gets play in this space because I was an AFBF Thanksgiving economist for 8 years (1995 to 2002). I love the educational value it provides as well as the annual tradition. There is no downside. In the last 40 years, even when the prices increase, the Thanksgiving meal is still a great food value.

The value of this survey multiplies as multiple news outlets pick it up and run with it. Today the Wall Street Journal covered the Thanksgiving meal value based in part on the AFBF thanksgiving survey. For me, that is a home run! The USDA, Economic Research Service has a chart that shows 11 months of the year family food expenditures away from home drive food prices. But for one month November (into December), food at home expenditures are higher than food away from home expenditures. On 11/24/25, Dawn Thilmany, Department Head, Colorado State University, Fort Collins, posted an excellent review of 2025 holiday food prices. In her Forbes article she mentioned 1 in 4 Americans host a Thanksgiving feast in their home. Food preparation is a love language.

The media focus on Thanksgiving and holiday food preparation is on consumer prices. These often back their way into various available supplies and the influence on price. Currently, most of the US meat industry is vertically integrated. Chickens for meat, turkeys, some egg production, hog production, and fed cattle are produced under production contracts. These farms contract with the owners of the animals to produce and raise meat and poultry animals. This shifts the risk from the farmer to the animal owner, such as Tyson Foods. The farmer contracts to grow the animals for a base price. The revenue for the farm is a fixed ‘production’ expense for the meat company. The farm revenue from production contracts becomes more complicated to identify than simply the final value of their production.

Since 2023, USDA has begun reporting the contract price. In gathering data for this article, it was found that USDA has posted an adjusted base price received for hogs, broilers, and turkeys. This is long overdue. Well done, USDA!

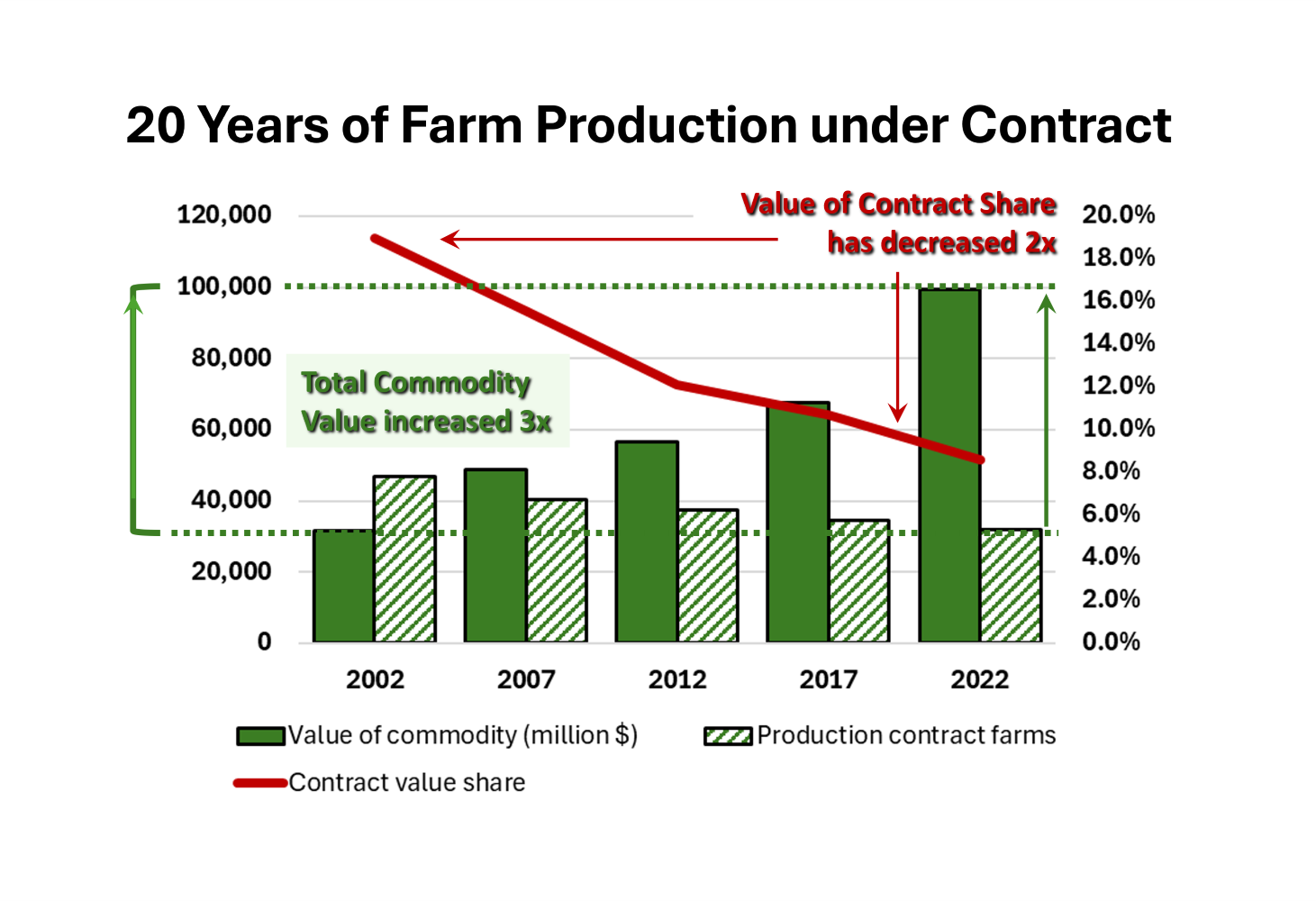

In the 2002 Census of Agriculture, USDA began reporting both the commodity value and the contract payment received for selected commodities. This was also very illuminating. In this chart, the historical values for spanning the last 5 census reports have been provided. The data does not exist to look specifically these contracts over the same 20-year time span. The value data presented in today’s chart is for all crop and livestock species reported as produced under production contracts. The Census Table number changes from census to census, but for 2022 the information in this chart came from Volume 1, Table 42: Commodities Raised and Delivered Under Production Contracts: 2022 and 2017. [For Turkeys in 2022, 1,802 farms produced 185,807,624 turkeys under contract. This is 72 percent of all turkeys sold in 2022, but it has remained at this share of production since 2002].

Today’s chart illustrates that the value of all species contracts is 3 times greater in 2022 than it was in 2002. This reflects an increase in market value through supply and demand. These values have not been adjusted for inflation. What is more interesting is the percentage of market value paid to producers in their contracts is half the value received in 2022 over where it began in 2002. The fixed payment made by meat companies apparently does not change.

The values reported that broiler growers received in 2024 in the USDA, Quick Stats data portal is $0.052 per pound. This is effectively the same price growers received 25 years ago. USDA Quick Stats reported turkey growers received a base price of $0.07 per pound in 2024. This is 7 to 10 percent of the value of the respective pork and poultry meat commodities.

By definition, to be in the Census of Agriculture, a farm must produce $1,000 of value in a given year. For contract producers the value of production does not indicate the same as other commodities directly marketed from their farm. For most livestock and poultry, contract production is more common than for the farms to own their animals. There are farms that do find ways to innovate and own their animals. This is no longer the main practice. Simply relying on the reported value of production does not represent the livestock and poultry sector.

The increasing access to production contract data through USDA adds great market transparency. These production contract payment values do not follow commodity market prices, Farm income forecasts that included livestock and poultry revenues must be adjusted to reflect the contract payments, rather than the traditional market value. USDA continues to innovate and provide market transparency even in an environment of budget accountability. Well done! And, thank you!

Comments

US Turkey Growers Do Not Receive Same Market Benefit as the Industry — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>