Food Price Inflation is Small Relative to Production and Manufacturing

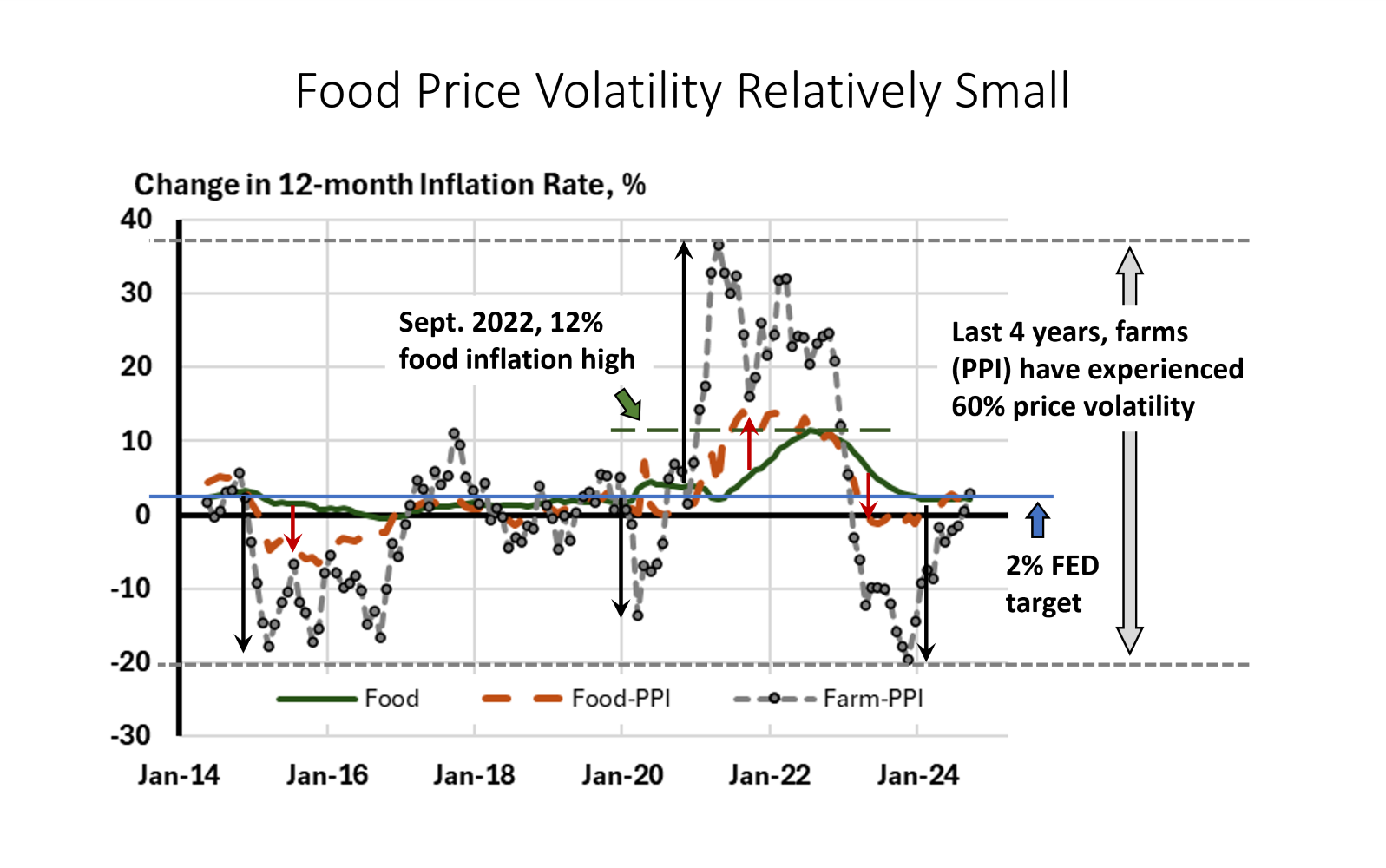

If this chart looks familiar, it is because this is the food price inflation chart used in the post, ‘Food Prices are Not Driving 2024 Inflation – Real Adventures in Economics. The difference is the scale of the vertical axis. The earlier food inflation y-axis spanned 20 percentage points. This chart has a vertical axis range of 70 points. This chart has added food manufacturing cost prices to farming cost prices to retail food prices. The volatility of these producer costs makes food inflation, solid green line, look small.

Prices paid for resources by food manufacturers are reflected in the Producer Price Index (PPI) for food manufacturers. The easiest method for downloading this data is to use the Federal Reserve, FRED data. This is represented by the rust-colored dashed line in the chart. Moving down the market channels from retail food, manufacturers receive lower prices than the retail sector, but their prices are much more volatile.

The most erratic price index is the farm PPI. Since 2020, farm PPI values have increased by as much as 37 percent (May 2021) and have declined below zero change to -20 percent (December 2023). Farmers receive lower prices compared to the food manufacturers and food retailers. In 2023, USDA, ERS reports that farmers received only $0.09 of each food dollar in 2023. Yet, yet in the last 4 years, their prices have increased by 37 percent and declined by 20 percent.

- Cost Volatility = Farm Volatility >> Food Manufacturer Volatility >> Retail Food Volatility

- Revenue Generation = Farm Sales Value << Food Manufacturer Sales Value << Retail Food Sales Value

Why is this? These are complex relationships. Some of these changes can be forecast from the information that is understood. Much of the farm price volatility is caused by unexpected, often unforeseen factors and interdependent relationships with other markets. Both farm and manufacturing sectors understand these dynamics and find ways to compete successfully in these industries.

Retail food prices are dependent on commodity prices. Commodity prices, more than upstream products and services, are at the whim of supply and demand. Farmers do not set grain prices. Biomass Rules has been defining the retail restaurant market channel as:

- Restaurant retail prices = f(grocery retail (distribution (processing (commodities (inputs)))))

Commodity prices fluctuate wildly compared to retail product prices. That volatility is born mostly by the farmer, but the food manufacturers cannot escape the commodity price fluctuations either. As food products and services move up the market channel, the relative value increases and helps mitigate the impact of the price fluctuations as food moves to the retail sector.

What can be done to lower the cost of fluctuating food prices for consumers. One policy tool that has played a critical role for over 90 years is the farm bill. The first farm bill was established in the 1930’s to provide stability to farmers so they did not turn the nation into a dust bowl by mining the soil. The economic drivers have changed over the last 90 years, but the price fluctuations continue.

It is a great story. Last week in, ‘Deriving Real Values for AFBF’s Thanksgiving Survey – What the Function,’ it was illustrated that in the last 40 years Thanksgiving grocery prices have pretty much only increased due to inflation. Competition for customer’s business has kept food producers and retailers razor-sharp efficient in keeping the non-inflation related cost increases to zero.

As discussed in, ‘Import Tariffs Do Not Lower Prices – Real Adventures in Economics,’ and discussed by others. Increasing tariffs that are tied to agricultural trade will also increase prices for consumers.

As this piece is posted, there is no reauthorization of the expired 2018 farm bill and discussions are that the United States is moving into a new era of increase import tariffs. We will not go backwards. It is quite possible that other policy changes could offset these two historical factors. And even if 2025 does not see a new farm bill and import tariffs increase, if the economy does begin to derail, new interventions will be developed.

Historical data is invaluable, but we constantly innovate and improve technologies and policies. This is as much a historical fact as policy tools that have worked in that past.

I totally agree.