Off-Farm Income as a Farm Household Business Risk Management Tool

Farm management focuses on business decision making for the business unit of the farm. But access to external cash-flows from off-farm income takes some pressure off the total dependence on the success of the farm business unit.

Farm Enterprise Analysis

Historical production records illustrate that the bottom 20 percent of producers on the low end of profit, have much higher costs than the top 20 percent of producers.

While teaching at University of Missouri Extension 10 years ago, I found data on 500 Missouri cow-calf producers over a dozen years. Summarized, the net returns in this data report,

- The lower 20 percent bracket lost $483.72 per cow (-$482.72).

- The middle 20 percent broke even, a positive $0.12 per cow, but $40 more than the average for all farms. And,

- The top 20 percent had a positive gain of $242.94.

Somehow when 500 farms were tabulated for 10 years, the average of the farms was -$39.47.

I am acquainted with this level of return. In 1988, the last year of Jenner Farms farrow-to-feeder hog operation looked similar to the bottom 20 percent. In my case, there were multiple reasons we were in the red. Jenner Farms wasn’t bad at raising hogs, there were simply too many things that collided at once to make it profitable.

Characteristics of U.S. Small Farms

Jenner Farms would have been more stable if an expansion had been possible. Getting larger is one method of lowering per-unit costs. The large number of small U.S. farms are expanding.

Small farms can be profitable even if they do not appear to be. When the 2022 Census of Agriculture results were released in February 2024, one of my first posts raised questions about what farm ‘size’ means. Is it value ($), volume (bushels, head), or acres? About half of the 1.9 million US farms in the 2022 Census of Agriculture have fewer than $1,000 of production. Although 15,000 U.S. farms have fewer than 100 acres and sold over $1 million in sales.

USDA defines a farm as having $1,000 of sales (or the potential to have). The question is, ‘Who are these one million, smaller farms without $1,000 of production?’ There are lots of answers. Some of these farms are just starting out. Some are realizing their farming dream is not working and it is time for another kind of career. Smaller farms are the pool of innovation and hope for the future that is just beginning. Small farms also the represent the legacy of a lifetime of aging farming knowledge and experience that are physically restricted due to age.

I have worked with farmers operating hundreds of acres of crops, feeding chickens or hogs, running beef cows on their pastures, AND they have at least one off the farm source of income. Are these farmers authentic, even though there is off-farm employment?

ABSOLUTELY!

Managing Enterprises within the Farm Household Business

Farm households in the 21st Century are businesses with both farm and off-farm enterprises. The smaller farm enterprises could be crops and/or livestock, at levels that an inherited share of farm resources allow or beginning farms with limited investment resources. Off-farm enterprises in the larger household business contribute like farm enterprises.

In a diversified farm operation that produces crops that are fed to livestock, the farm must operate each enterprise efficiently. If the livestock operation is masking a poorly managed crop operation, or the other way around, the diversified farm will not do as well as when both enterprises are managed well.

In the same vein, today’s farm household business needs to manage the off-farm income and the on-farm income as enterprises to be optimized. When the off-farm income is providing stability, the farm enterprises may not get the optimal attention. Even so, during planting and harvesting, or during calving season, the off-farm revenue may not get all the attention it does at other times.

When managing farm and off-farm enterprises as a household business, making effective management decisions is efficient, even if the enterprise analysis shows it is not in the top 20 percent of operators.

Off-farm income allow the purchase of the most productive, state-of-the-art equipment that 500 acres by itself would not support, may be a sound business investment. It is simply using the off-farm income to manage on-farm assets. With capital being supplied externally, it allows the operating costs to be higher than a farm without external resources.

Our U.S. working farm management knowledge is the best in the world. It must be shared through Universities and Extension services with the focus on managing a closed farm business to be meaningful. But if farms operate with off-farm income and their costs look different than the published values, it does not automatically indicate poor management.

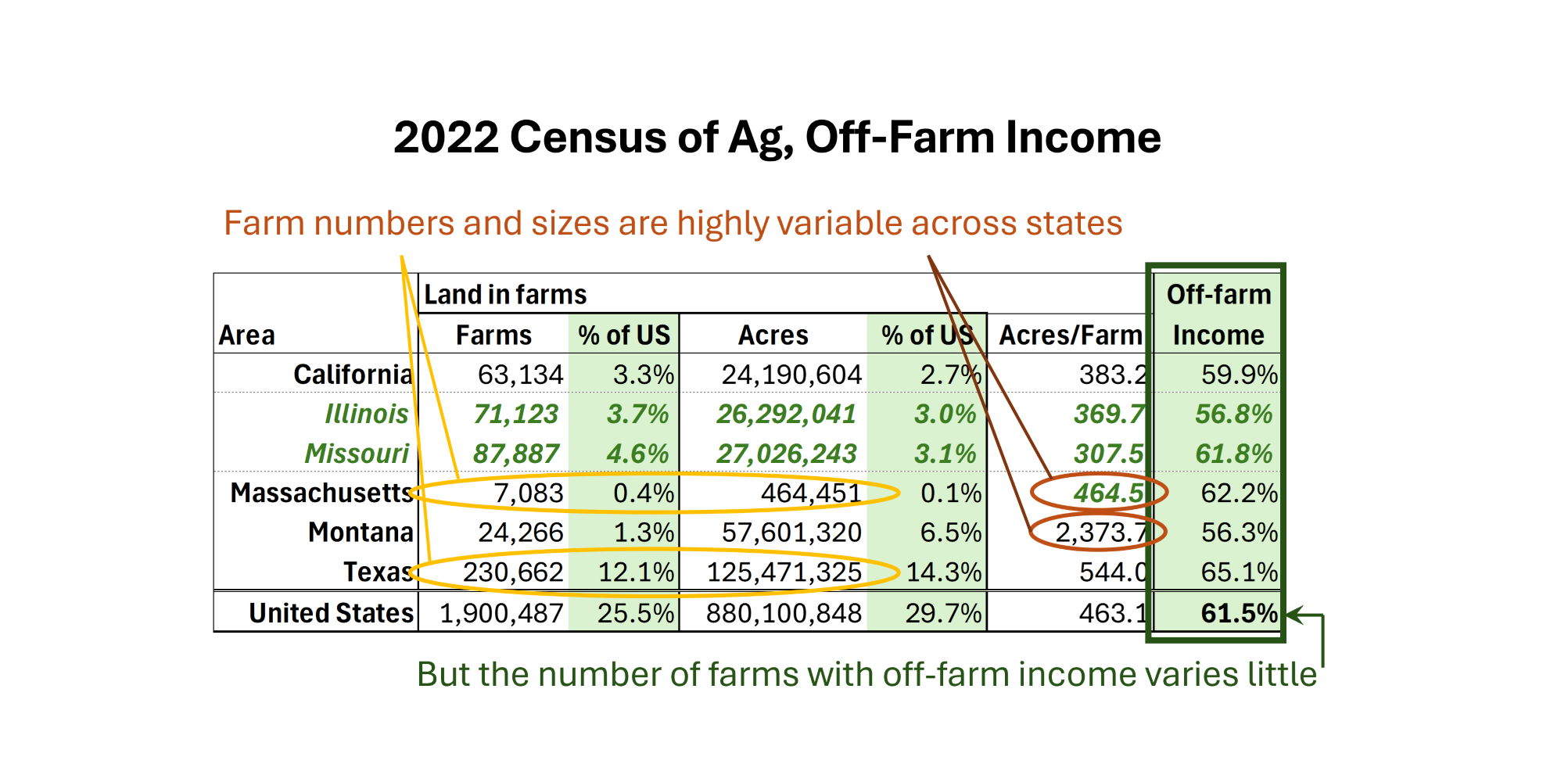

The associated table today, is from the 2022 Census of Agriculture, state level tables in Volume 1, Chapter 2, Table 45. Selected Operation and Producer Characteristics: 2022. Six states are selected subjectively for their similarities and differences: California, Illinois, Missouri, Massachusetts, Montana, and Texas.

What can we learn from this?

- Texas is huge. Nearly a quarter million farms on 14 percent of the US land in farms.

- The US average farm size is 463 acres per farm

- Massachusetts is small in number and acres, but the average farm size is nearly equal to the US average farm size.

- Montana has fewer farms than Illinois, but double the land in farms. Montana’s average farm size is 2,374 acres per farm. That is the state average.

- California dwarfs the value of production for the other 49 states, but its farm numbers and farm acres are not that large. Only a little larger than Illinois and Missouri.

- Missouri and Illinois share boundaries along the Mississippi River. Illinois average farmland price is more than double the state average price for Missouri farmland, but their farm and farmland numbers are not dissimilar.

- All three states, CA, IL, and MO, have farm sizes in acres per farm that are lower than the average US farm size.

NEARLY CONSTANT across all states and the U.S. is the percent of farms with off farm income. It is steadily 60 percent. This is solid risk management for farm families that cannot be large enough at this time to operate at the optimal levels.

Comments

Off-Farm Income as a Farm Household Business Risk Management Tool — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>