A Tale of Two Biodiesel Feedstocks – Winners and Losers

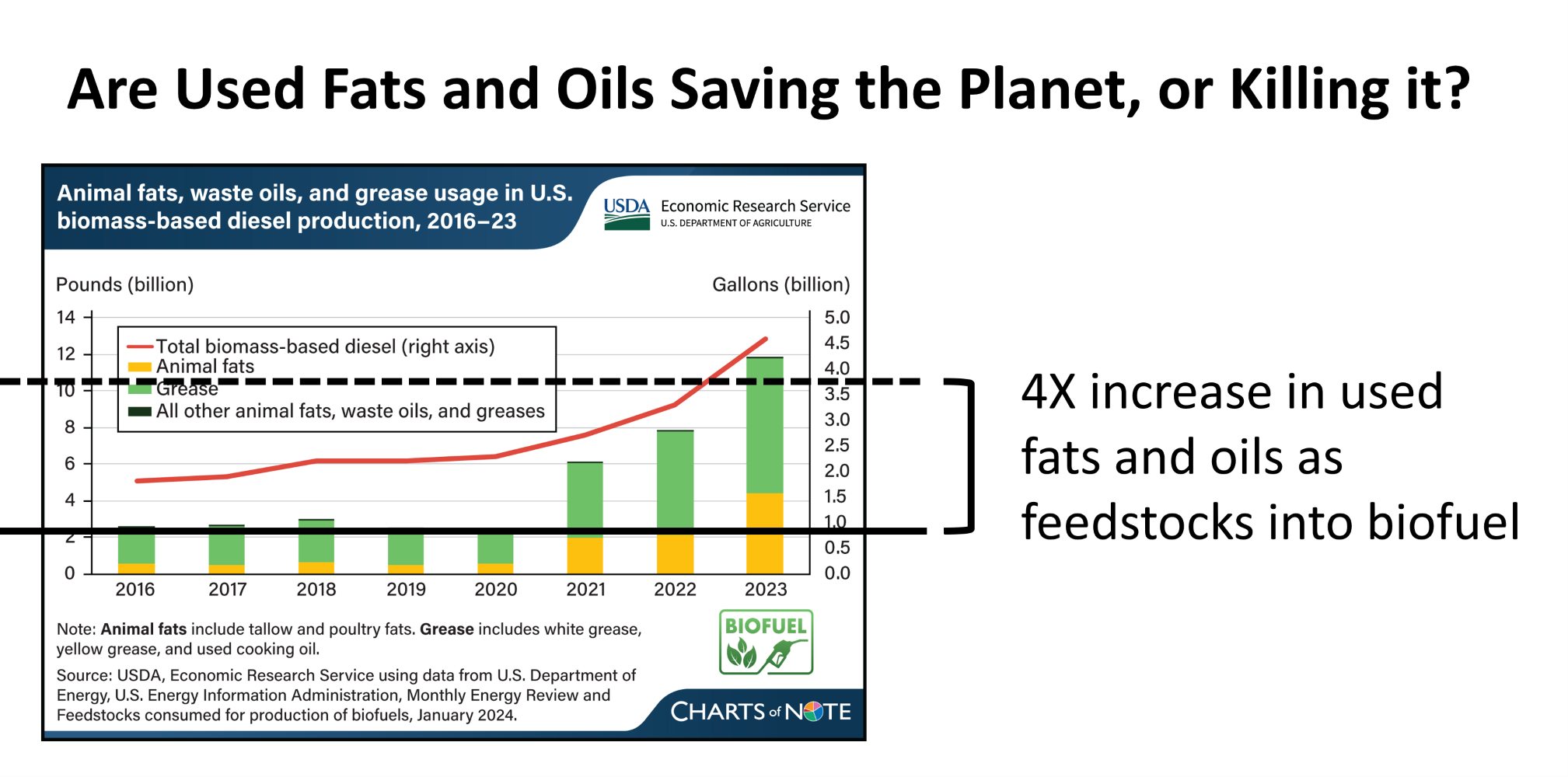

Last week, USDA, Economic Research Service (ERS) posted this chart on used oil as feedstocks in biodiesel production. This USDA chart indicated that we are pulling undervalued fats, oils, and greases into higher valued uses as transportation fuel. This promotes cleaner fuels and greater economic efficiencies which is not measured in the Gross Domestic Product (GDP).

This chart is less about the supply of used oil, and more about the use of used oil specifically as biomass-based diesel fuel. On the left side of the chart, very small amounts of used oils are used in biodiesel production. On the right side of the chart, used oils are increasing in utilization of a biodiesel feedstock. This chart is focused on biodiesel fuel production. As the industry is discovering, there is a sea of underutilized fats and used oils in the world. Even so, pulling a small portion into the transportation market is good news.

This is a win-win in the view of Biomass Rules.

Reading American Soybean Association, Scott Gerlt’s, excellent article, “Increased Feedstock Imports Push Soy from Biofuels” gives a different story. In this very well written coverage of very complicated factors, poorly constructed policies, unanticipated access to global used oils, and aggressive expansion of soybean processing capacity, used oils and fats may be an economic challenge to the valuable US soybean industry.

Twenty years ago, it was easy to show that based on market prices alone, the cost of the first use of vegetable oil for biodiesel feedstocks was a bad idea. Vegetable oil, unlike soybean meal, is human food. However, the first generation conversion technology, FAME biodiesel, made the use of the more expensive, clean, virgin vegetable oil, the best value biodiesel feedstock of choice. Food always pays more than transportation fuel or livestock feed. Still, in the existing supply chain, the entry-level, FAME conversion technology worked better with cleaner feedstocks. Over the next 20 years, the evolution of state and federal biofuels policies pointed toward vegetable oil as a good economic bet.

For an excellent description of traditional (FAME) biodiesel and renewable diesel see, Gerveni, M., T. Hubbs and S. Irwin. “Biodiesel and Renewable Diesel: What’s the Difference?” farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023. The next generation of biodiesel (renewable diesel) allows the use of dirtier feedstocks and thus as Scott Gerlt illustrates, today the transportation fuel industry can capitalize on the cost savings from used fats oils and greases.

But, here we are. The emergence of a soybean industry processing capacity imbalance is not good economic news in the near-term, anyway. In the long view, the US and global economies continue to generate more from fewer resources. We are living longer and improving our quality of life every year. It is not simply more value.

The ethanol industry was launched in the 2000s by concerns over water quality from the oxygenate (fuel additive) MTBE. MTBE was added to protect air quality from degrading from volatilizing gasoline. When 17 states banned MTBE (added for air quality, but creating water quality issues), they replaced it with ethanol. Not long after the federal government created the Renewable Fuel Standards. Curiously, the renewable fuel policies are not managed by business development agencies, but by the EPA.

The U.S. Economy is moving forward and the quality of life is improving. Here is a short list of progress:

- After all that has happened, we still have the air quality protections against excessive gasoline volatilization. We no longer have water quality problems from MTBE. And the US has substituted 10 percent of the transportation fuel with ethanol and biodiesel.

- The September 11, 2001 attacks on the United States, prompted a fierce drive to become less dependent of foreign fuels. Biofuels play a small part in that success, but it is significant.

- State agencies have responded to the federal RFS with their own more restrictive Low Carbon Fuel Standards. All of these federal and state policies continue to evolve.

- The transportation fuel industry has invested heavily in renewable fuel conversion technologies.

- The U.S. soybean industry invested heavily in additional soybean processing capacity.

- Domestic use of our agricultural and biobased products is increasing, over the value of serving external markets through international trade. Is this a bad thing? No. It is driven by greater values domestically. But it will look different than our historically strong export markets.

- The soybean industry will adapt. The U.S. ag value chain is the best in the world at adapting.

- Difficult to communicate benefits from continuous and unrelenting competition in all markets, ag, bioenergy, and environmental services, will keep consumer prices as low as possible.

Change is always costly. But cumulative, often difficult to monetize benefits continue to outpace those costs.

Comments

A Tale of Two Biodiesel Feedstocks – Winners and Losers — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>