Anaerobic Digestion of Food Waste is Growing

New market demand for renewable natural gas (RNG), or biogenic methane, is growing. First, the EPA AgStar historical farm digester data was charted to illustrate the rapid recent growth in farm digesters. Next, the EPA Landfill Methane Outreach Program (LMOP) historical data was then charted to show the early rapid growth followed by a slower growth in the near term. This post highlights EPAs limited anaerobic food waste digestion. While there are tiny places where they overlap, these biogenic methane datasets are largely separate sources of biogas.

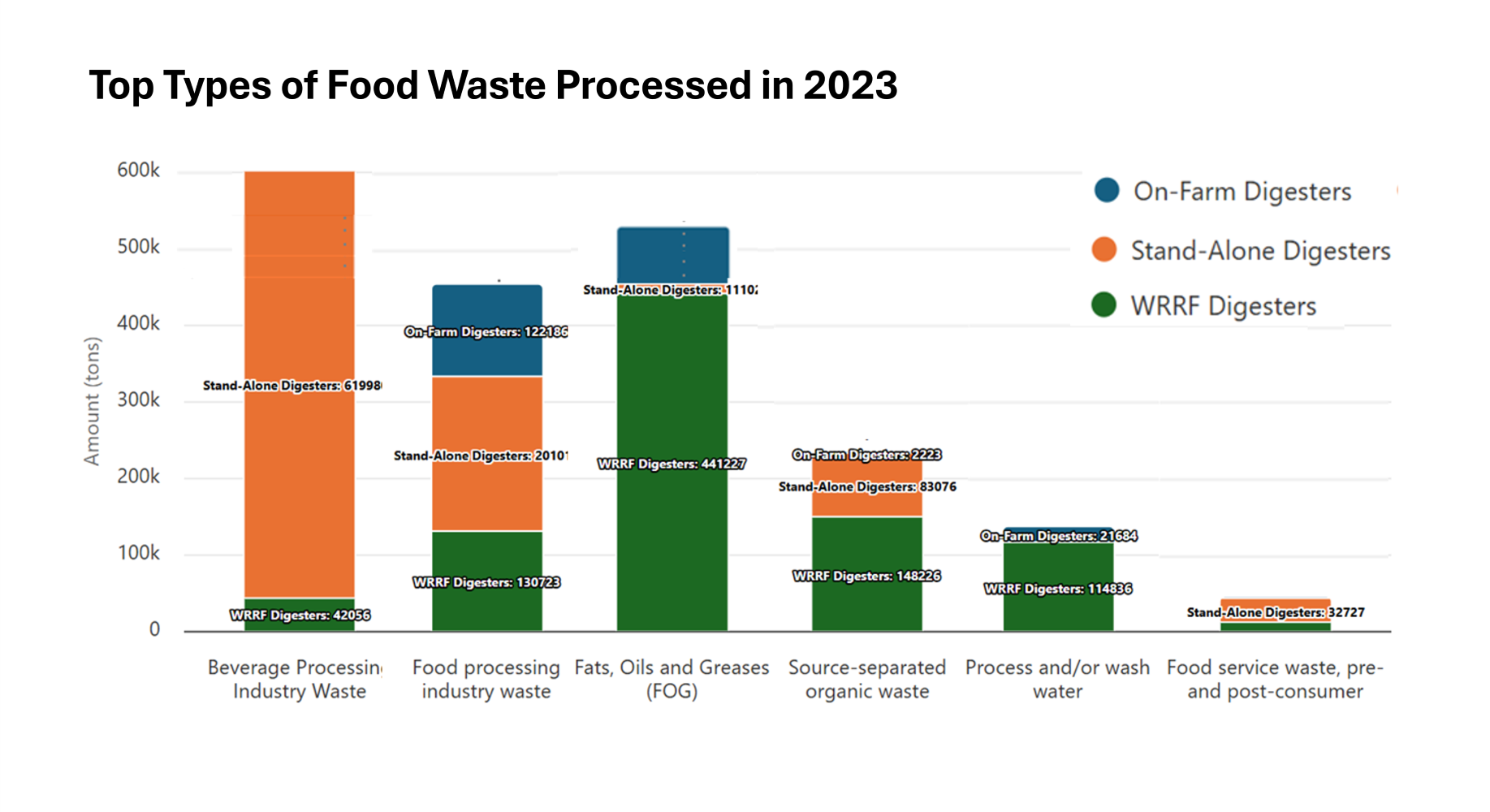

Today’s chart is from the October 1, 2025 report, Anaerobic Digestion Facilities Processing Food Waste in the U.S. (2022 & 2023). This dataset is still in the early years of development and is not as robust as the prior two EPA biogenic methane datasets.

This is the chart from USEPA’s October 2025 report. An effort was made to enhance this chart, but even so, it is still difficult to visualize. The best part of this chart is the introduction of Water Resource Recovery Facility (WRRF) Digesters. These are wastewater treatment plants. EPA reports that the surveys were sent to 128 WRRF digester facilities and 30 reported back in 2024 and are part of these numbers. The three categories of anaerobic digesters included in this survey included:

- Stand-alone digesters (food waste without manure or wastewater; 20 operating respondents out of 96 units surveyed, or 21% response).

- On-farm digesters (where the digester was located on the farm and co-digested with food waste; 15 operating respondents, out of 89 units surveyed, or 17% response),

- Co-digestion systems at WRRFs (food waste co-digested with wastewater, 30 operating units out of 128 units surveyed, or 23% response).

In total 313 facilities were contacted in 2024 and 65 operating units (21 percent) responded to the survey questions. The other two EPA datasets, AgStar (manure) and the LMOP (landfill) datasets were more census like than survey response dependent. This emerging dataset simply isn’t quite as complete. If the 21 percent that responded are representative of all 313 digester units, the volumes reported here are likely as much as 4 times larger. This is not reliable yet, but it is fair to report than the activities of this dataset are small compared to the total operating units.

Another very interesting aspect of this food processing waste dataset is that it is not simply one type of food waste. It is MANY different types of food processing waste. The EPA reported that “in 2022 and 2023, the top six types of food waste processed from most to least were as follows” (in descending order by volume):

- Beverage processing industry waste (liquid).

- Food processing industry waste in 2022; fats, oils, and greases in 2023 (oils).

- Fats, oils and greases in 2022; food processing industry waste in 2023 (oils).

- Source-separated commercial, institutional, or residential organic waste (solids, slurry).

- Process and/or wash water (liquid).

- Food service waste, pre- and post-consumer (solid, slurry, oils, and liquids).

These are all very different wastes. These are reported out by the category of digester (food waste only, on-farm food waste, and food waste at WRRF).

The top line/highest volume reported in this chart is 600 tons of food waste processed annually. This chart is a subset of the responses received. In 2023, EPA reported that 7.7 billion tons of food waste were processed. Not all these are included in the attached chart. This chart highlights the six kinds of food waste by location category of energy conversion technology.

One aspect that stratifies these feedstocks and conversion technologies is that all of these organic waste residuals are regulated wastes. Human sewage is regulated more stringently than livestock manure. Food waste is regulated differently also. The landfill gas projects are regulated by the solid waste rules, the Clean Water Act rules and air emissions fall under the Clean Air Act regulations.

The regulations are there to keep the US environment safe for everyone. But each waste stream regulation has developed differently. And creating a business to generate revenue requires navigation of each regulation separately and together. While working with the BioTown, USA project in Northwest rural Indiana 20 years ago, we identified that the proposed biomass power plant would require five permits. We were utilizing every kind of liquid and solid waste that contained carbohydrates (biomass).

But here we are. This is the great news! The biogenic methane industry in all its forms has 1) kept the public safe by navigating all the environmental laws in place, and 2) found a way to generate revenue that is greater than the costs (profitable). It is a win-win.

While these three datasets are publicly available, they are in the nature of public data, incomplete. There is often a year or two lag between industry activity and what gets reported publicly. It is still good news.

Comments

Anaerobic Digestion of Food Waste is Growing — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>