Byproduct Price Discovery in the Absence of Demand – Real Adventures in Economics

Agricultural byproducts are not produced on demand. The quantity of byproduct production is based on the demand for the higher valued commodity or product. This is not news. But it seems forgotten in the passionate discussions of waste cooking oils in the production of biofuels, renewable diesel fuel, and sustainable aviation fuel (SAF).

Agricultural production wastes and byproducts are a pool of unwanted outputs in search of a market demand. In the case of recycled (converted) paper, in the last 50 years byproduct (waste) paper output has displaced 60 percent of the market for newly milled paper. Recycled paper has become a substitute for new paper. The output of wastepaper byproduct is not increased to meet an increasing retail paper price. An increase in retail demand for paper may increase the wastepaper byproduct, but it does not go the other direction.

This took nearly 50 years to reach this current equilibrium.

The world will not increase used vegetable oil output to create enough sustainable renewable biofuels. The quantity of available used vegetable oil happens in the cooking oil marketplace, not from biofuel demand.

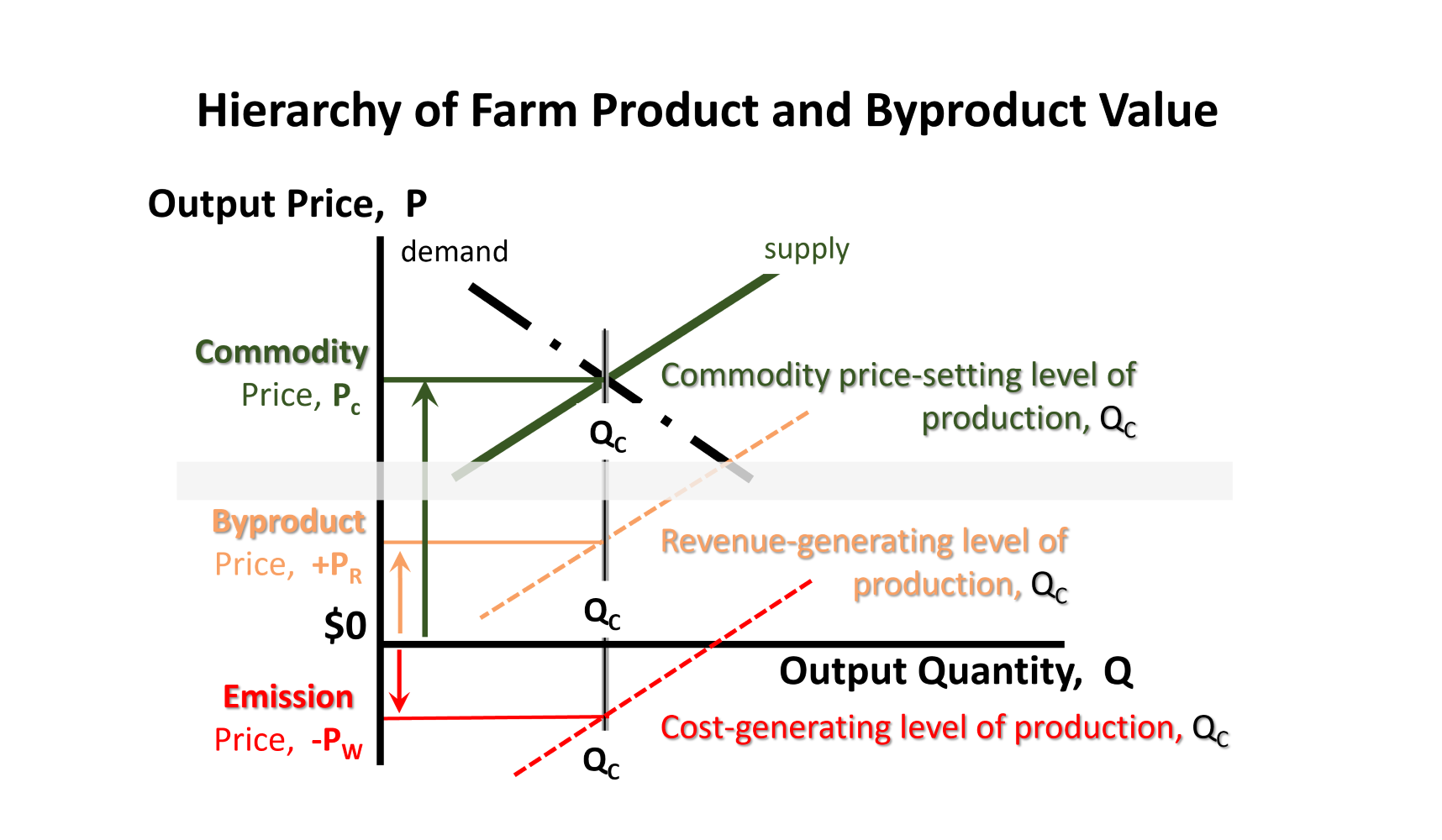

Byproducts and waste prices start at the lowest available price. When byproduct supply overwhelms the demand for that byproduct, there is a negative price, and any cumulative value is negative. When this occurs, the producer manages the waste emission by paying disposal costs.

Successful industries find higher-valued markets in which to move their byproducts. The production quantity of the byproduct is set by another market. Whey protein production is fixed by the demand for cheese production. But the quantity of whey protein moving into the current food ingredient market (highest value) is a more efficient use of resources than when it moved into a waste disposal market of the 1960s (only a cost).

- It is the same whey byproduct (now refined to have a consistent product quality).

- Similar quantities of whey byproduct are produced. Now it is just moving into a market with a higher demand.

- The marginal cost of refining the byproduct of cheese production is much lower than the positive value of selling dry whey protein into the food ingredient market (revenue > costs).

- Like recycled paper, this transition was a multidecade development. A new infrastructure was developed. Policies, education, and new market channel development (macro costs) occurred before revenue was developed.

- But in the end, there were fewer emissions and greater economic growth. It is an economically efficient solution.

The most graphic example is the case of an egg laying chicken. The same chicken produces an egg and manure out of the same orifice. Physically, each day a chicken will likely produce one egg and the same quantity of manure. The number of chickens raised is not determined by the price/value of manure. It is determined by the price of eggs. Which in December, the Bureau of Labor and Statistics reported as $4.15 a dozen. We are used to paying less than that for eggs in the United States, but compared to other animal protein sources, $0.34 per egg, or $1 for the eggs to make a 3-egg omelet is still a pretty good deal.

The nutrient and energy in manure do not command as high of value. However, if manure can move into a manure nutrient market, or a manure energy market with limited further processing, it can provide a positive price. When the positive price is equal to the disposal cost, it is a breakeven transfer (revenue = cost). When the disposal costs are greater than a positive manure revenue, it is a waste emission with a negative value.

What is going on with used vegetable oil?

Used vegetable oil is finding the highest value for something that was produced in the high valued food market. It gets a little messy here. Subsidies for biofuels have created several situations where the soybean oil market has driven soybean planting rather than the traditional soybean meal market. Soybean oil has a higher value per pound than soybean meal, but the demand for soybean meal usually sets the acres planted in the United States. These two soybean dependent markets, meal and oil, contribute to the price and demand for soybeans. While much more complicated than chicken eggs and manure, the products and byproducts are cumulative.

Another agricultural product/byproduct market is wheat and wheat straw. Wheat acreage is planted on the price and demand for wheat grain. The annual production of wheat straw depends on the secondary market demand for wheat fiber or straw. The demand for wheat straw is separate from the demand for wheat grain. Straw demand does not drive grain production.

The take home messages:

- Agricultural byproducts are produced at quantities that are set by the products with which they are associated with a higher value.

- There is also a hierarchy of agricultural market values discussed in an earlier blog. From highest value to lowest value it is: Food > Fuel > Livestock Feed > Fiber > Environmental Services.

- Newly available feedstocks like used vegetable oil are seeking higher valued markets than their currently available/traditional markets. That quantity is determined by the first-use markets for vegetable oil. But the quantity of available domestic used vegetable oil is not as vast as the quantity of foreign used vegetable oil. The universe of globally available used vegetable oil is likely insufficient to power a global or even US transportation fuel market.

- Moving poorly utilized and undervalued byproducts into the economy as higher valued, repurposed transportation fuel markets can be an economically efficient investment. (It still depends on the actual benefits and costs. Good intentions are not sufficient to make it work).

Byproduct markets are multidimensional. This post focused on monetizable market options for secondary byproduct outputs. Not included in this discussion are difficult to monetize benefits of local reuse into other onsite processes. Use as fertilizer or refeeding on the same or nearby farm may not move through a market with a price. This is valued as an equivalent cost offset. Various policies can shift a target market to meet policy objectives, which render native market functions less intuitive. The gains in economic efficiencies and reduction of economic cost of wastes make the adventure worthwhile.

Comments

Byproduct Price Discovery in the Absence of Demand – Real Adventures in Economics — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>