Avoid Inflated and Spurious Correlations

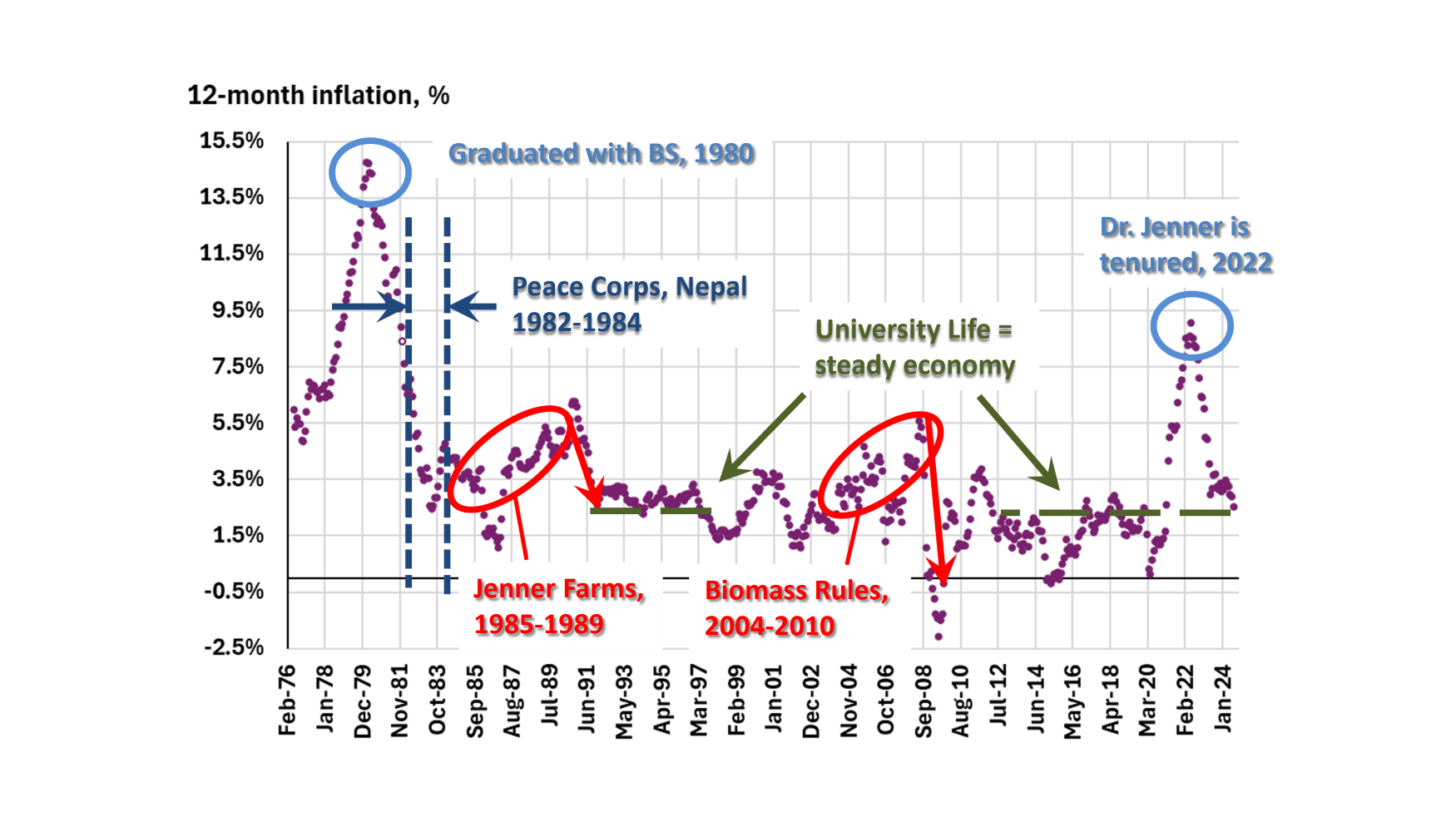

It is an election year, and the number of charts showing the economy-wide influences by a single factor are up. A recent chart making a thin claim about the cause of inflation struck me as a similar rhythm to my career. It was easy to recreate!

Looking at a 40-year series of monthly changes in U.S. inflation recently,

- Prices increased over time in both businesses I operated in the 1980’s and 2000’s. In each business, the economy-wide price increase led to rapid price declines.

- I enjoyed explaining to my undergraduate economic students that the reason the base price for the CPI is set at 1982 to 1984 prices, is because Mark Jenner was out of the country and therefore more economic stability because of that. Inflation is calculated from the CPI. 1982 to 1984 = 100.

- Similarly, two of my lifetime achievements occurred at the peak of high rates of inflation: my BS degree in agronomy from 1980, and the achievement as a tenured faculty in 2022.

Does this pattern between Jenner’s businesses and career achievements have any connection to price levels in the United States?

No. None. Zero. This works more because I have changed careers often than because any career has had a powerful inflationary influence.

I do enjoy mocking associations as causal to make a point. Traditional relationships fail when there is either missing data or new data available that changes the influence on one factor or another. I was poking at this practice when I plotted of my career over the price of crude oil in June. That any single career would influence the globally shaped price of crude oil is more association (coincidence) than causal.

Data that moves together without a direct cause are referred to as spurious correlations. Association, rhythms that are similar, is different from inflation causing my career activities or my choice in career activities causing inflation. Career choices were made based on economic shifts, but these were influenced by more than a single factor like inflation.

There are similar inferences in the news and social media every day. This year, it shows up in Presidential tenures. These sorts of associations are excellent seedbeds of innovation in analytical work. Experience and intuition provide new insights from which everyone can gain. But single variable causality like U.S. inflation and one other factor, doesn’t happen. The U.S. economy is too large and robust. A U.S. President is a powerful position and is the single most influential human on the economy, but the other factors outside of a President’s control with a longer time horizon than four years, are more influential than even a U.S. President.

This is the undergraduate economics teacher speaking. Don’t take the headlines or the two-dimensional charts at face value. Fact-check every position (not just the ones you don’t agree with). Policies and indicators that worked 10 to 20 years ago, are likely not working like they used to. Too many changes are happening too rapidly.

Think critically and be creative in forming solutions. The most obvious influential factors likely have the most easily accessible data. Not necessarily the most representative data.

Long ago, a brilliant economist, and also a close friend, told me manure had no value because there was no established exchange market price. He was correct in the 1990’s. But today Renewable Natural Gas (RNG) – often created from manure – pays a premium over traditional fossil fuel natural gas (and still no market exchange price for manure).

And yes, even when it is clearly written that there is no connection between Mark Jenner’s career and inflation, the chart sort of indicates there may be. It may look like my two businesses caused inflation to increase, then drop rapidly. It may look like cause-and-effect, but it is not. Statisticians and economists call it spurious correlation.

Pay attention. Think critically. If something doesn’t track, check it out.

Comments

Avoid Inflated and Spurious Correlations — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>