Unpacking the Reported Negative Equity of Used Cars

The Wall Street Journal reported this week that used cars are losing value faster than they have been. The term negative equity was discussed. In the article, car owners were required to settle their loan prior to the full term, and could not recover the value of the principal balance. This can be a problem.

However, it provides a perfect opportunity to discuss how interest rates and loan terms can influence management of the liability of borrowed funds. Borrowed money can be a great management tool, but poorly managed, it can lead to negative equity.

There are at least two factors that have influenced U.S. car loans in the last few years.

- The number of months that a car loan can be financed has been increasing: 36 months, 48 months, 60 months, etc. It is now possible to finance a car purchase over 7 years, or 84 months.

- During the supply-chain shortages following the pandemic, used car values went up faster than new cars. For a brief time, there were reports of used cars selling for more than new ones. Now that has changed. Used cars are back on schedule of losing value, or depreciating.

Returning to the normal of used car values being lower than new cars, doesn’t seem like news.

The one factor that does allow risk management is the choice of loan duration or term. In the old days, car loans were for 3 or 4 years (36 and 48 months). By the time the loan was paid, the value remaining in the car was still enough to build equity for the next car purchase.

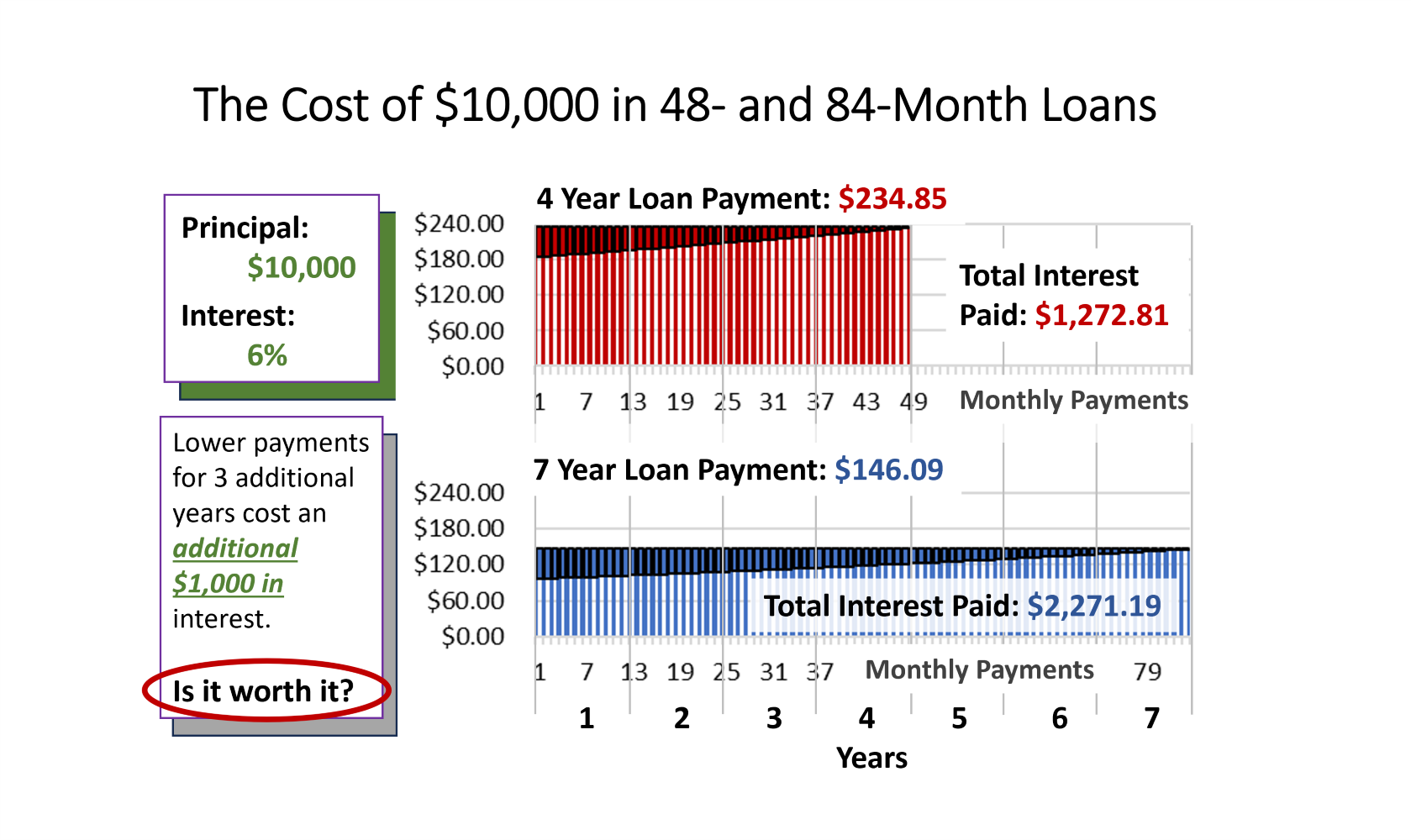

Today’s example looks at the length of loan with all other variable equal, the economist’s way. Assuming a loan for $10,000 at 6 percent interest annual percentage rate (APR).

- The 4-year/48-month loan term has a monthly payment of $234.85. This included interest and principal. Interest is paid more rapidly than principal, but the monthly payments are fixed. Interest on $10,000 for the 48 months is $1,272.81.

- The 7-year/84-month loan term has a monthly payment of $146.09, nearly $90 less per month. But the interest paid on $10,000 over 84 months is $2,271.19. It costs $1,000 more to finance the use of $10,000 for 7 years.

The risks are higher for the 84-month car loan emerging with equity that is not positive, than for the 48-month loan. The life of a car devalues rapidly in the first 10 years. After the first decade, a car the resale value will likely be a fraction of the new purchase price. A new vehicle that cost $20,000 may only have a resale value of $4,000 after 10 years. Certainly, older cars will sell for more. This is a worst-case scenario for comparative purposes.

- The longer loan term of 84-months costs $1,000 more in this case.

- Plus, in the additional 3 years, the resale value is lower, potentially declining by 30 percent in the additional 3 years.

The value of the car at 4 years and 7 years doesn’t change regardless of the term of the loan, but if the car is owned free-and-clear of debt in year 5, it will command a higher trade-in value.

Something overlooked in most loan evaluations is the total interest cost of the loan. It seems like the interest costs should be 6 percent. In the 4-year loan case total interest cost is $1,172.81. This is 13 percent of the original $10,000 (about 1/8th of the principal). The total interest cost of the 7-year loan, $2,271.19, is 23 percent (nearly 1/4th of the principal).

The longer-term loans, like 84-months, may offer a lower interest rate. If the interest rate of the 84-month loan is 3 percent instead of 6 percent, the interest paid on the total $10,000 is back to ($1,100). Plus, the monthly payment drops to $132.13 per month. But at the end of the 7-year loan, the car will have a resale value of less than half of the purchase price.

In graduate school, the infusion of the semester’s student loan, made it possible to purchase a tiny new car (30 years ago). Once graduating with a PhD, and getting a job with a professional income, the tiny new car was sold. But it took 10 years to pay off the student loan. It always felt like the cost of deficit spending during graduate school was a liability until repaid for 10 years after graduation. In my mind anyway, that included the tiny new car that was long gone by the time the loans were repaid.

Borrowed funds are a powerful management tool. This is not a ‘don’t borrow money’ lesson. It is a ‘pay attention to the costs of borrowed money’ lesson. I have both made a lot of money on borrowed money and lost a lot of money on borrowed money.

Have fun and with your borrowed funds and change the world, …but pay attention.

Comments

Unpacking the Reported Negative Equity of Used Cars — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>