Midwest Land Prices Only Increase in the LONG View

Ten years ago, while working for University of Missouri – Extension, I had the privilege of joining a curriculum development team on estate and farm transfers. We developed the idea of a case, or at least believable story, to go along with the complicated legal and business jargon and address the real emotions of the process. I was charged with creating a credible story.

Farm families can sense information is not relevant to them. Extension depends on satisfied customers. We were motivated to impress our farm and agricultural business clients. This included a credible land value twenty years into the future.

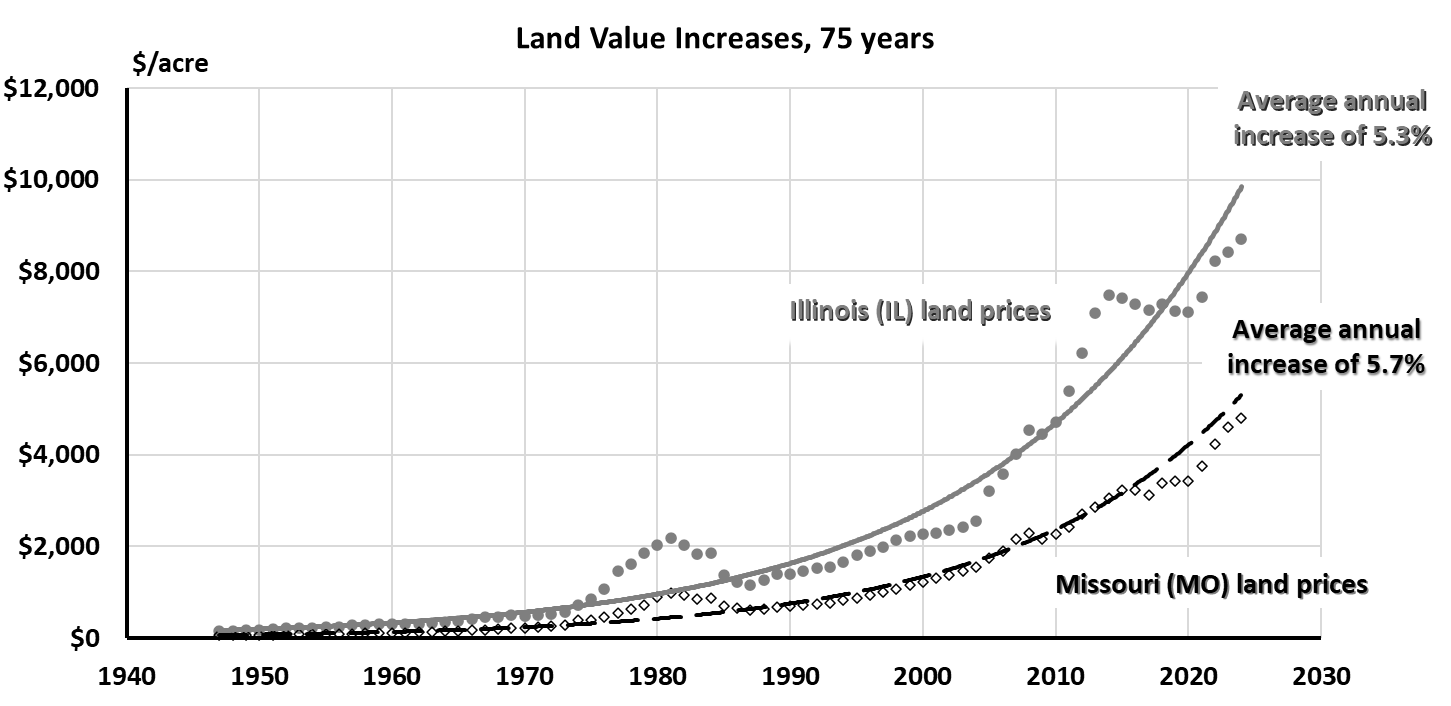

The case story land value increases spanned over 50 or 60 years to cover two generational transfers. Today’s exponential trendline is very helpful. These two neighboring states have interesting, long-term changes in land values. While Missouri’s state average value of land in farms is effectively half of Illinois’ state average value of land in farms, the consistent exponential growth is nearly the same.

Looking back, the increase of 5.3 to 5.7 percent over 75 years very believable. But these historical increases, looking into the future 20 years were unbelievably too high.

USDA land values are nominal and not adjusted for inflation. But the land values were much more believable 20 years into the future when adjusted for an average of 2 percent inflation. That meant future land values in the case story only increased by 2.5 to 3 percent each year.

After that methodology came together, it was intuitively correct. Land values increasing at 5.5 percent each year for 20 years is a good estimate, but if inflation is at 2 percent each year, the purchasing power will decline by that much. In twenty years, the land values will have increased by the higher value, but relative to everything else, future land values will feel more like a 2.5 to 3 percent increase.

USDA National Ag Statistics Service, NASS, released their Land Values 2024 Summary last week.

- Danny Munch, Economist at the American Farm Bureau Federation did an excellent job summarizing that report on AFBF’s Market INTEL page.

- Illinois FBFM Association and University of Illinois Economist, Bradley Zwilling also provided a different and excellent perspective on land price changes in Illinois.

I learned things from both commentaries. One of the insights I found particularly compelling was the 2022 Census of Agriculture created a reason to adjust previously reported Illinois state average land values downward slightly.

Living through nearly 50 years as a working adult adds a long view to the rapidly changing daily news. Having farmed in the 1980’s, those extremely high land prices, today, are not as impressively high.

- Land assets nearly always increase, or appreciate.

- Buildings and equipment begin to devalue, or depreciate, as soon as the paint is dry.

- Breeding assets are more unpredictable, as their value changes with the markets and their age (weight/size).

It is also important to note that USDA, NASS average land values are not farm property sale values. These are yearly averaged values across the state. Within both Illinois and Missouri, there are significant differences in agricultural land values at the same time in different areas of each state. State average land values are more of a benchmark of trending values than an investment tool.

Land values go up and land values go down (once in a while). But when tracked over 75 years the exponential trend in value increases is very consistent.

Comments

Midwest Land Prices Only Increase in the LONG View — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>